Get a copy of your Social Security 1099 (SSA-1099) tax form online

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free mySocial Security account.

What is a Social Security Benefit Statement?

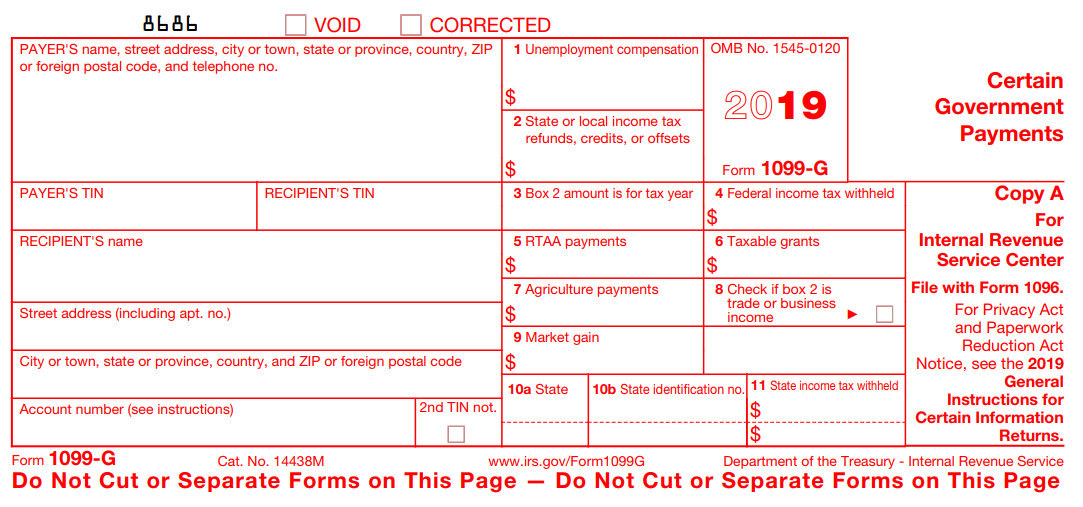

2019 Jan-11-2019: Form 1099-Q: Payments from Qualified Education Programs (Under Sections 529 and 530) (Info Copy Only) Nov 2019 Feb-21-2020: Form 1099-R: Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. (Info Copy Only) 2020. Payments made with a credit card or payment card and certain other types of payments, including third-party network transactions, must be reported on Form 1099-K by the payment settlement entity under section 6050W and are not subject to reporting on Form 1099-MISC. See the separate Instructions for Form 1099-K. Fees paid to informers.

Iwatermark pro 2 5 10 for mac free download. A Social Security 1099 or 1042S Benefit Statement, also called an SSA-1099 or SSA-1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

- Noncitizens who live outside of the United States receive the SSA-1042S instead of the SSA-1099.

- The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI).

- A replacement SSA-1099 or SSA-1042S is typically available for the previous tax year after February 1.

- If you don't have access to a printer, you can save the document on your computer or laptop and email it.

Sign in to your mySocial Security account to get your copy

Already have a mySocial Security Account?

Sign in to your account below and go to 'Replacements Documents' to view, save and print your SSA-1099 or SSA-1042S.

Don't have a mySocial Security Account? Abelssoft pdf compressor 1 0 1 download free.

Creating a free mySocial Security account takes less than 10 minutes, lets you download your SSA-1099 or SSA-1042S and gives you access to many other online services.

Still have questions?

If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.

Form 1099 for 2019 Tax Year with Instructions Typically, non-employment money is beyond taxation. But reporting them to the IRS is a must. Otherwise, you will definitely experience some really unpleasant consequences sooner or later. For business owners who have received over $600 in services or other income variations, sending this document to the vendors they've cooperated with is obligatory.Aside from reporting self-employed earnings, the 1099 2019 tax forms also register such revenue types as government benefits, various types of awards, rental payments, etc. Don't forget that now that you're here, you no longer need to search for the 1099 tax form 2019 printable template. It's all here on our site served for you on a silver platter.

Furthermore, we've prepared some really useful instructions related to the 1099 IRS tax forms for 2019 at our website. If you make the most of them, along with our tips (and your bookkeeper's advice), you will definitely succeed at handling your 1099s.

Follow these steps to properly prepare for completing your printable 1099 tax form 2019:

- Collect the required information about each independent contractor you hired during the last year.

- Access your 1099 tax forms printable at our website.

- Print the templates out or fill the forms online without having to do it manually.

- Send a copy to each vendor you've hired before February 1st.

- Don't forget to keep one copy for your own records — in case the Internal Revenue Service specialists have questions or specifications regarding the issue.

1099 Form Pdf 2019